This article describes the fields typical for a document form, i.e. an object based on a Do table. The description of the form structure, attributes and built-in fields available for all object types is available in the Attributes and standard built-in fields article.

Simple fields

Gross is a floating-point number with two decimal points. This field is automatically calculated. It depends on net and VAT fields.

Gross [cur] is a floating-point number with two decimal points. The field is automatically calculated. It depends on the fields.

Net [cur], as well as Currency and Exchange, are rate settings. The field is visible on the document form only when the Currency field is set to a different currency than the main currency.

Date of addition is a “date and time” field filled in by the system. The field value is automatically defined by the system when the document is created. The user cannot edit this field.

Receive date is a date field.

Pay date is a date field of data type and time, used in the Document payments fields.

Start date field is a date and time field used in absences or replacements.

Date of VAT status verification is a date field calculated automatically. The user is not able to change the value of this attribute. The value of the field is set each time by the function of the contractor’s VAT status verification.

Date of VAT-EU status verification is analogous to the Date of VAT status verification field but applies to VAT EU.

Send date is a date field.

End date is a date and time field used for absences and replacements.

Transaction date is a date field that defines the date of the economic event. It is used in accounting operations.

Added is an automatically calculated text field. It indicates the user who added the document to the system.

Department is a field related to the organizational structure of the company, which is used to associate the document with the department.

Company is a system field containing information about the company. When the system is used by more than one company, a menu appears with a choice of companies’ names to which the document will be assigned. It must be present on every form to be associated with a document type.

Payment method is a drop-down list type dictionary field. Defines the forms of payment on financial documents. It is used, for example, in the Payments attribute.

Category is an element associated with the system field category. Must be present on every form to be associated with a document type. More about document categories can be found in a separate article.

Code is a system field used to store e.g. barcode.

Bank accounts is a widget connected to a dictionary of bank accounts, allowing to associate a document with a particular account.

Contractor is a widget that allows connecting documents to the counterparty. In this field only the counterparty ID is stored, therefore, more often the Contractor(edit) control is used

Exchange rate is a floating-point number with two digits after the decimal point. This field is related to the fields Currency, Type of currency rate, Convert the currency exchange rate. It contains the rate at which the document is converted. Depending on the selection of the type of currency rate value it can be converted automatically – the value taken from the bank’s exchange rate table – or entered manually by the system user.

Warehouse is a system field associated with the warehouse dictionary. It allows a document to be linked to a selected warehouse.

Warehouse source is a system field associated with the dictionary of warehouses. It allows the document to be associated with the selected warehouse.

Modified by is a system field filled out by the system. The field value indicates the user who last modified the document. The user cannot edit this field.

Name is a text-type system field.

Net is a floating-point number with two decimals the field is automatically calculated. It depends on the sum of net values from the elements field.

Net [cur] is a floating-point number with two decimals; the field is automatically calculated. It depends on the Net field and Currency and Rate settings. The field is visible on the document form only when the Currency field is set to a different currency than the main currency.

External number is a text field containing the number of the external letter.

Personal number is a text field that is partially automatically calculated. It consists of fixed elements like letter marking, automatically calculated elements like current month or year is taken from another system field like document date and another number. Configuration of the own number elements is in the document type configuration.

Delivery is a field analogous to the contractor. It allows binding the document with the recipient. In this field only the receiver’s identifier is stored, therefore the Recipient (edit) control is used more often.

Description is a multi-line field allowing to add longer text without formatting to the document.

Convert the currency exchange rate is a button-type system field linked to Currency, Type of currency rate, Exchange Rate fields. When the button is pressed, the document is converted: Net [cur] and Gross [cur] are calculated following the rules defined in the Currency Conversion Rate control.

Type of currency rate determines how currency amounts are converted into the main currency. Possible values:

- Average Central Bank exchange rate from the proceeding day (Purchase date)

- Average Central Bank exchange rate from the proceeding day (Document date)

- Set currency rate (manually entered exchange rate)

VAT Status is a system field. If VAT status is checked on the type of documents, the result of the status check is displayed in this control.

VAT-EU status is similar to the VAT status field, it refers to the VAT-EU status.

Status is a system field that defines the document status

Currency is a selection field used to indicate the currency of the document. When a currency other than the main currency is selected, the fields Type of currency rate, Currency, Net [cur], VAT [cur], Gross [cur] are available and there is an option to select currency decreation in the Assignments control (currency decrement availability is configurable from the document type option level).

Main currency is a system field that defines the main currency of the document.

VAT is a floating-point number with two digits after the decimal point. It is automatically calculated. It depends on Net and VAT fields.

VAT [cur] is a floating-point number with two decimals the field is automatically calculated. It depends on the fields Net [cur] and Currency and Exchange rate. The field is visible on the document form only when the Currency field is set to a different currency than the main currency.

Owner is a system field that allows you to indicate the owner of the document. The owner is selected from a list of company employees.

Type is a system field that specifies the type of document. If multiple document types are based on one form, this is the field that allows you to select the type of the mentioned forms. Depending on the selected type, fields on the form may have different configurations (visibility, edibility, etc.). This field also controls the selection of the circulation procedure. It must be present on every form to be associated with a document type.

Paid is a floating-point number with two decimals.

Paid [cur] is a field dependent on Paid, calculated automatically depending on the settings of the Currency and Exchange rate fields. The field is visible on the document form only when the Currency field is set to a different currency than the main one.

Complex fields

Assignments is a dedicated widget used to enter assignments for financial documents. The control is configured through the document type configuration and allows documents to be decree based on dictionaries defined in the system (e.g. cost center, employee, accounting account, etc.).

There is the possibility of an additional configuration of account assignment controls. The control itself has been divided into components – the actual control and the components, i.e. dictionaries consisting of document elements be posted.

There is the possibility of an additional configuration of account assignment controls. The control itself has been divided into components – the actual control and the components, i.e. dictionaries consisting of document elements be posted.

When creating a new document, in addition to adding an accounting widget, you also need to add accounting dictionaries. All dictionaries in the system can be selected.

This feature allows system administrators to control elements (columns) of documents assignments, depending on values of other fields in the document and on values of SQL statements.

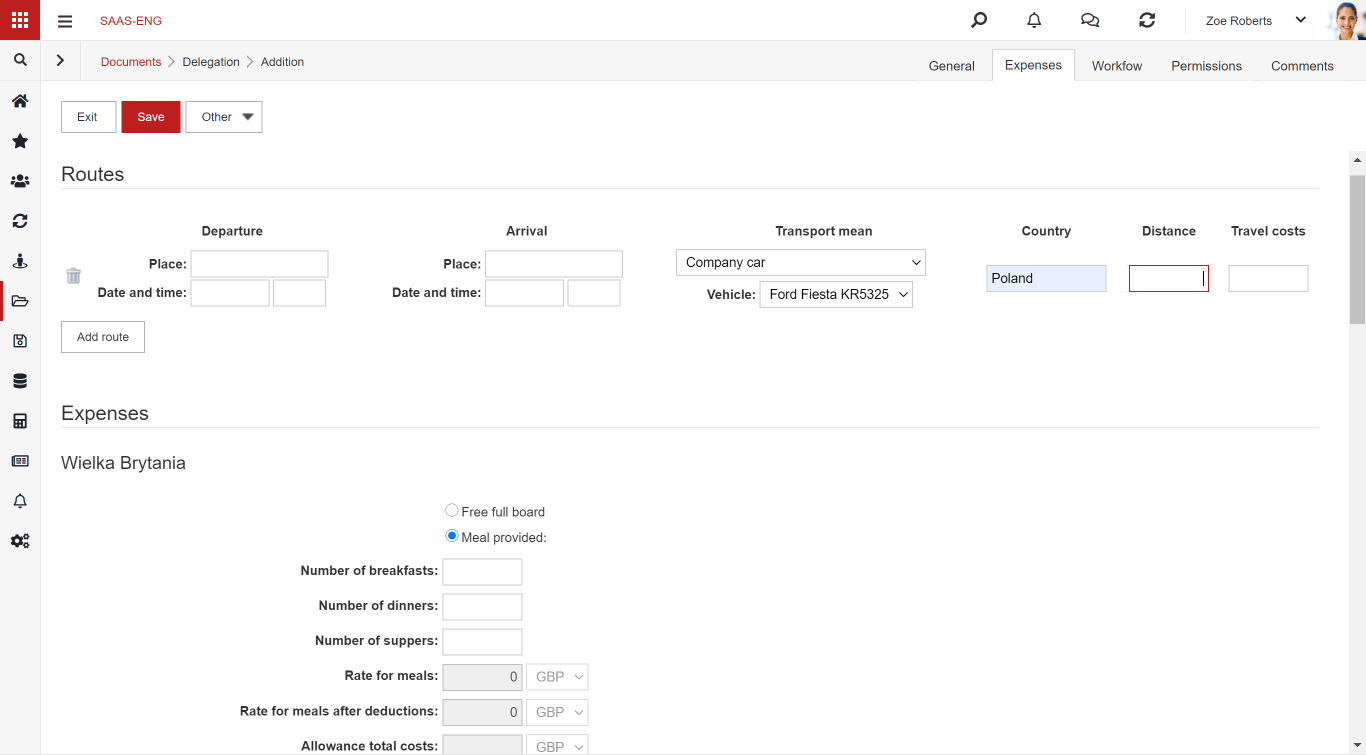

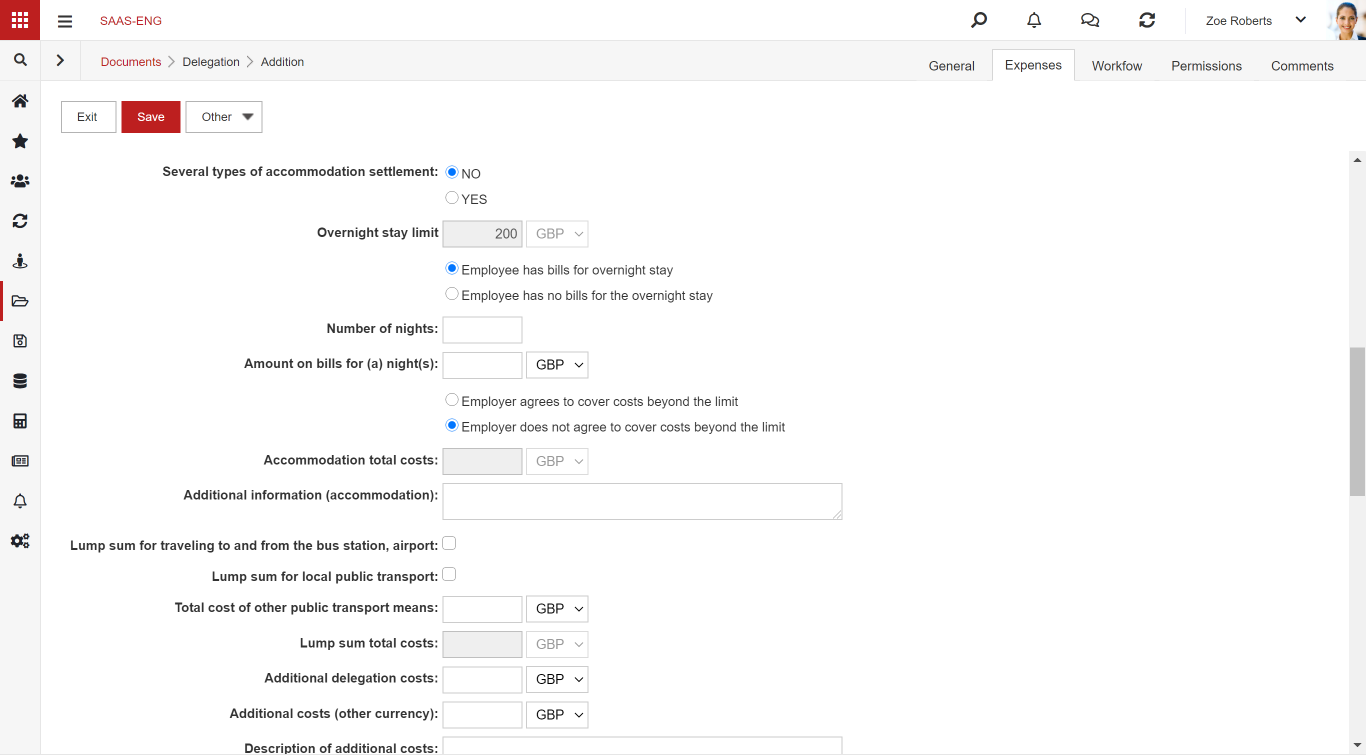

Business travel expanses is a dedicated widget for entering data indispensable for business trip settlement. It allows entering travel costs, accommodation costs, and other costs related to business trips. Allows the costs to be settled in main currency or other currency. Control panel view example:

Accounting document is a widget used to link a document to the financial operations journal.

VAT register document is a widget used to link a document with a VAT register.

Contractor (edit) allows you to link a document to a contractor. On a form, it has the appearance of a compound control that allows displaying Tax identification number next to the name. The widget also has a built-in mechanism for searching the contractor database by the Tax identification number or name. If the user has permission to add beneficiaries. After entering the Tax identification number they can search for a beneficiary in the Tax identification number database and add them to the system.

Contractor address (edit) is a widget closely related to the Contractor (edit) control, most frequently used together with it. After selecting a contractor, the contractor’s address appears in this control.

Contractor to ship (edit) is a widget analogous to the Contractor (edit) that allows associating a document with a recipient. On a form, it has a structure of a complex widget, which allows displaying Tax identification number next to the name. The widget also has a built-in mechanism for searching the recipient database by the Tax identification number or name on the basis of the Tax identification number database.

Contractor to ship address (edit) is analogous to Contractor address (edit) closely related to Recipient (edit) control. Most often it is used together with it. After selecting a recipient in this widget the recipient’s address is displayed.

Document payments is a widget that allows to display all payments – both scheduled and effected – related to a given document.

Lists and tables

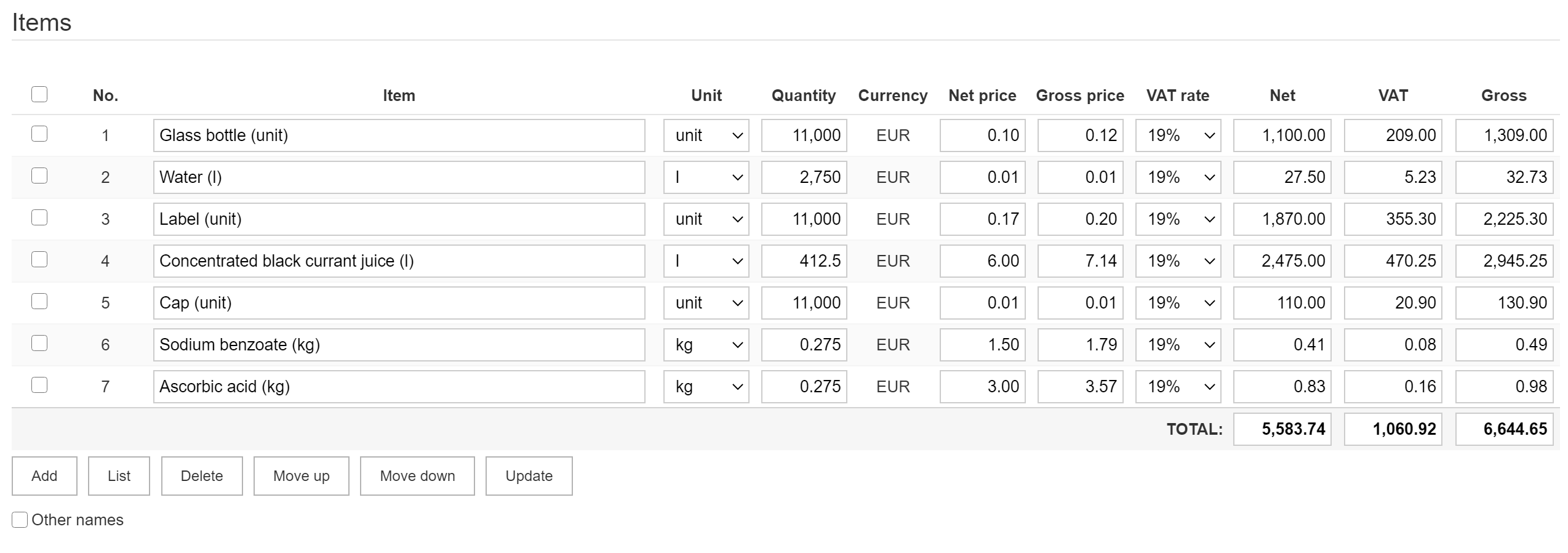

Elements is used for entering assortment (goods) on financial documents. It is associated with the list of assortment.

The widget has special properties that allow to calculate of the values in the list. Depending on the configuration, it is possible e.g. to enter the net amount, VAT rate and recalculate the gross amount or to enter the gross amount and recalculate the net amount.

Invoice correction is a complex widget used in correcting invoices. It allows you to link the basic document with the corrected document.

VAT rates table allows you to break down the values from the items control by VAT rates.

Account value is a system widget dedicated to breaking down the value of a document into accounting entries. It is the basis for the possible integration of Navigator with an accounting system.

Substitutes is a system widget that allows you to add substitutions for absences. You can assign substitutions for a specific person for a specific time and a specific document type. You need to configure the system by specifying the types of documents that will be substituted. Configuration is described in a separate article.

For the widget to function properly on the form there must be additional fields Start date and End date.